Helping Freelancers Save More For Retirement

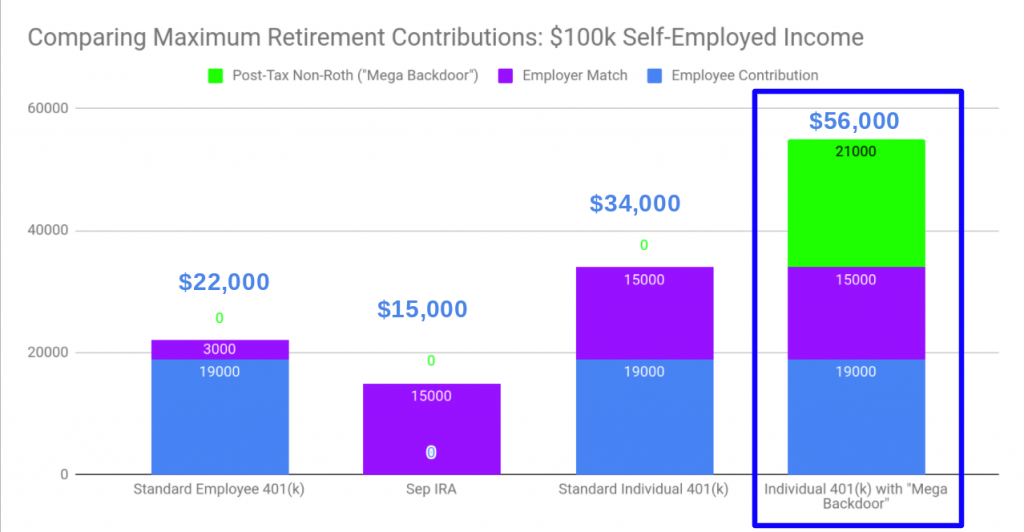

Maximizing retirement savings – the My401k advantage

This is possible by creating your own retirement plan: a self-directed, Individual 401(k), giving you more control over your retirement than ever before.

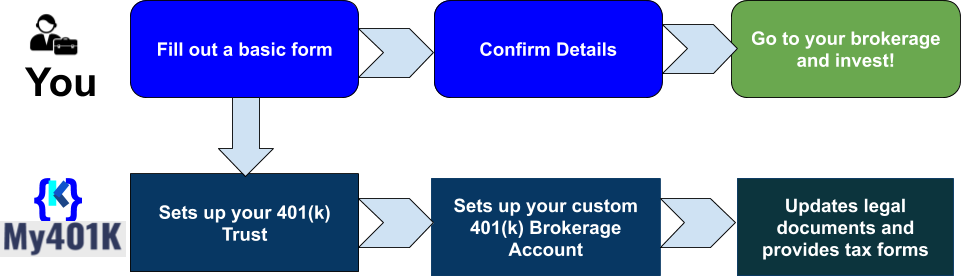

Creating and managing a self-directed 401(k) used to be difficult, but My401(k) helps you get started with a few simple steps.

A Self-Directed 401(k) is the only way to maximize your retirement account.

Freedom of Choice

Your 401(K) can be used to invest in many services, or just the basics. Choose a brokerage and we’ll allow you to maximize retirement savings there.